nebraska property tax calculator

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Its a progressive system which means that taxpayers who earn more pay higher taxes.

Nebraska Inheritance Tax Update Center For Agricultural Profitability

Tax Calculators Tools Tax Calculators Tools.

. The median property tax in Nebraska is 176 of a propertys assesed fair market value as property tax per year. Nebraska is ranked number seventeen out. Nebraska provides refundable credits for both school district and community college property taxes paid.

The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription. This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. Nebraska Income Tax Calculator 2021 If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680.

AP Nebraska taxpayers who want to claim an income tax credit for some of. 15 Tax Calculators 15 Tax Calculators. The Nebraska Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Counties in Nebraska collect an average of 176 of a propertys assesed fair. Each credit is equal to a distinct percentage multiplied by either the school district.

The Federal or IRS Taxes Are Listed. For comparison the median home value in Douglas County is. Tax amount varies by county.

There are four tax brackets in. Nebraskas state income tax system is similar to the federal system. Nebraska launches new site to calculate property tax refund February 17 2021 OMAHA Neb.

The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. 2021 Tax Year Return. The Federal or IRS Taxes Are Listed.

Simply close the closing date with. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Nebraska property tax records tool to get more. Registration Fees and Taxes.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Your average tax rate is 1198 and your marginal. For comparison the median home value in Lancaster County is.

Our Nebraska Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. The Nebraska Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. Nebraska paycheck calculator Payroll Tax Salary Paycheck Calculator Nebraska Paycheck Calculator Use ADPs Nebraska Paycheck Calculator to estimate net or take home pay for.

Driver and Vehicle Records.

Are There Any States With No Property Tax In 2022 Free Investor Guide

Nebraska Property Tax Calculator Smartasset

How Taxes On Property Owned In Another State Work For 2022

Feeling The Squeeze The Negative Effects Of Eliminating Nebraska S Inheritance Tax Open Sky Policy Institute

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Nebraska Real Estate Transfer Taxes An In Depth Guide

Taxes And Spending In Nebraska

Property Taxes Jump Most In Four Years With Sun Belt Catching Up

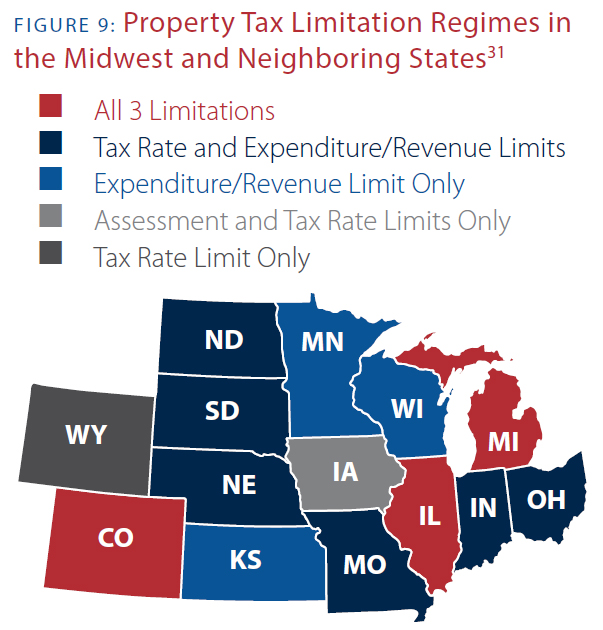

Get Real About Property Taxes 2nd Edition

Property Tax Calculation Douglas County Treasurer

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

Property Taxes Sink Farmland Owners The Pew Charitable Trusts

Can You Explain The Proposed Property Tax Increase For Knoxville Tennessee Mansion Global

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Nebraska Income Tax Ne State Tax Calculator Community Tax

Tax Calculator Chanute Ks Official Website

Which States Do Not Have Property Taxes In 2022 Ny Rent Own Sell

States With The Highest And Lowest Property Taxes Property Tax Tax States