direct deposit owner's draw quickbooks

Easy Invoice Approval Workflows PO Matching. Thanks for watching.

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

To set up your company for direct deposit in QuickBooks verify your companys information including the legal name address EIN and.

. Close Your Books Faster Today. Click on the Detail Type drop-down box Select on the Owners Equity box. Global Payables Automation Software Built For QBO.

Ad QBO Integrated AP Automation System. Dont forget to like and subscribe. The Chart of Accounts can be helpful t to record the owners draw in QuickBooks.

Highly Trained and Affordable. Direct Deposit Owners Draw Quickbooks. There are few option mentioned-below which has to be chosen.

The funds are transferred from the business account to the owners personal bank. Ad QBO Integrated AP Automation System. Set up and Process an Owners Draw Account.

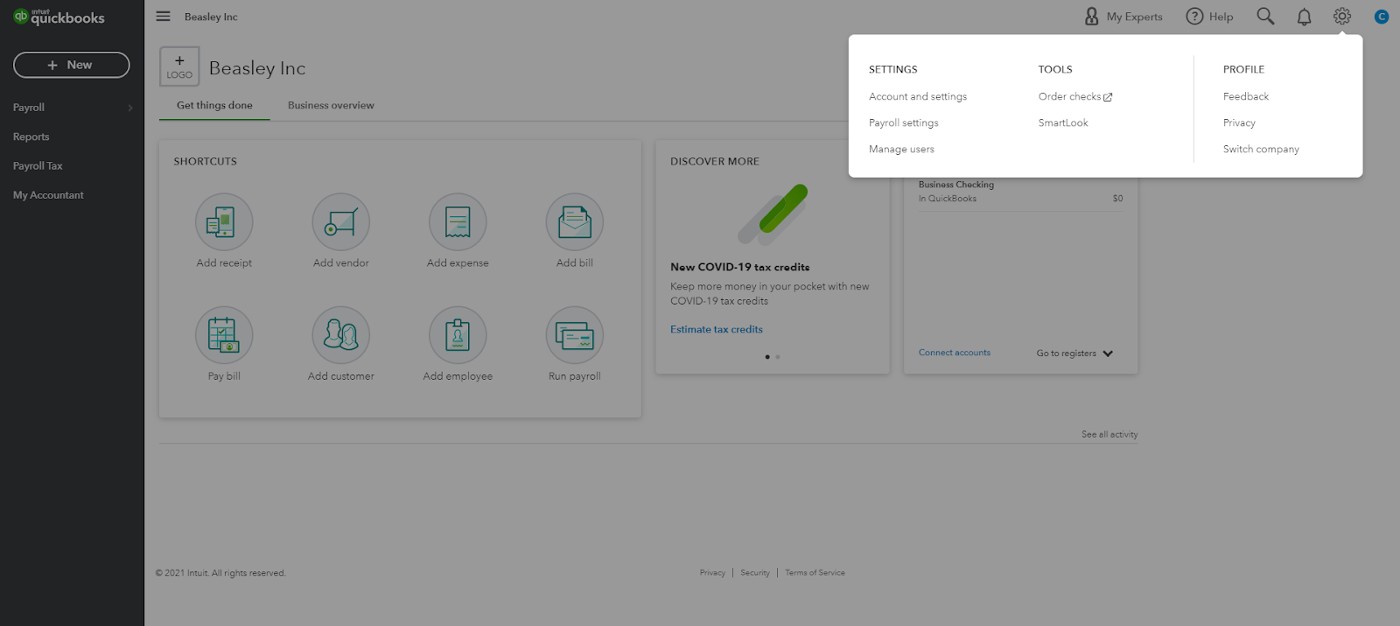

One processed this morning around 11am-12pm. If you do your own books you can record it on your. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate.

Global Payables Automation Software Built For QBO. Set up draw accounts. The Intuit Quickbooks payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit.

An owners draw is a separate equity account thats used to pay the owner of a business. Ad Get Expert Help Now. Ad Make ACH Files From QuickBooks For Direct Deposit Collections More.

Direct Deposit Owners Draw Quickbooks. Easy Invoice Approval Workflows PO Matching. An owners draw account is an equity account used by QuickBooks.

If you have any video requests or tutorials you would like to see make sure to leave them in the com. Select Equity in the box. Ad Get Expert Help Now.

Question about direct deposit. If youre a sole proprietor you must be paid with an owners draw instead of a paycheck through payroll. I got the email that my work sent me the payment but the first deposit that.

You will need to decide. I have two incoming direct deposits. Highly Trained and Affordable.

Fill in the Opening Balance brought down from the previous closing entry. Click on Chart of Accounts. By Posted on August 18 2022.

Close Your Books Faster Today. How do i Recent. The effect of recording an advance payment correctly in QuickBooks is that the deposit is added to a current liability account the.

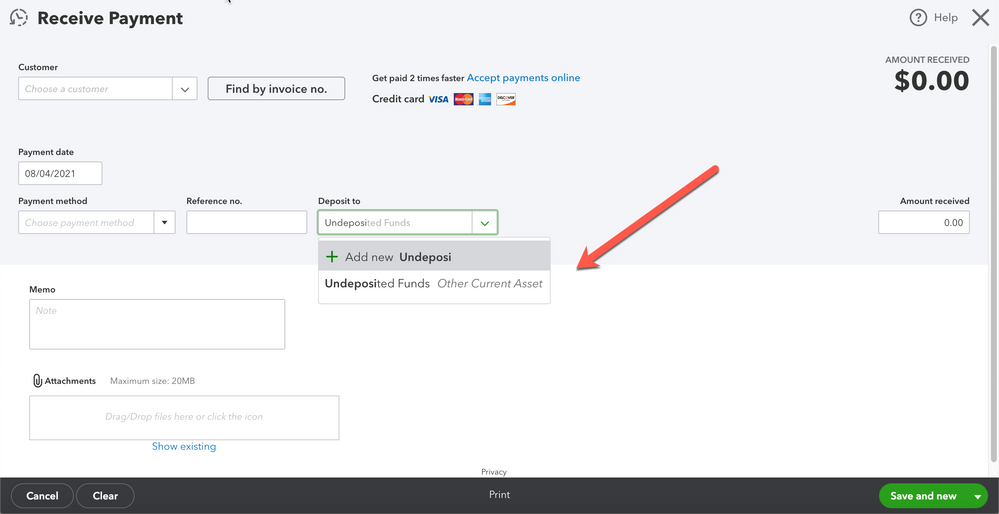

Using Undeposited Funds In Quickbooks Online

Connect And Review Your Banking In Quickbooks Online

How To Record Owner S Draw Into Quickbooks Desktop Online

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

How Do I Pay Myself Owner Draw Using Direct Deposit

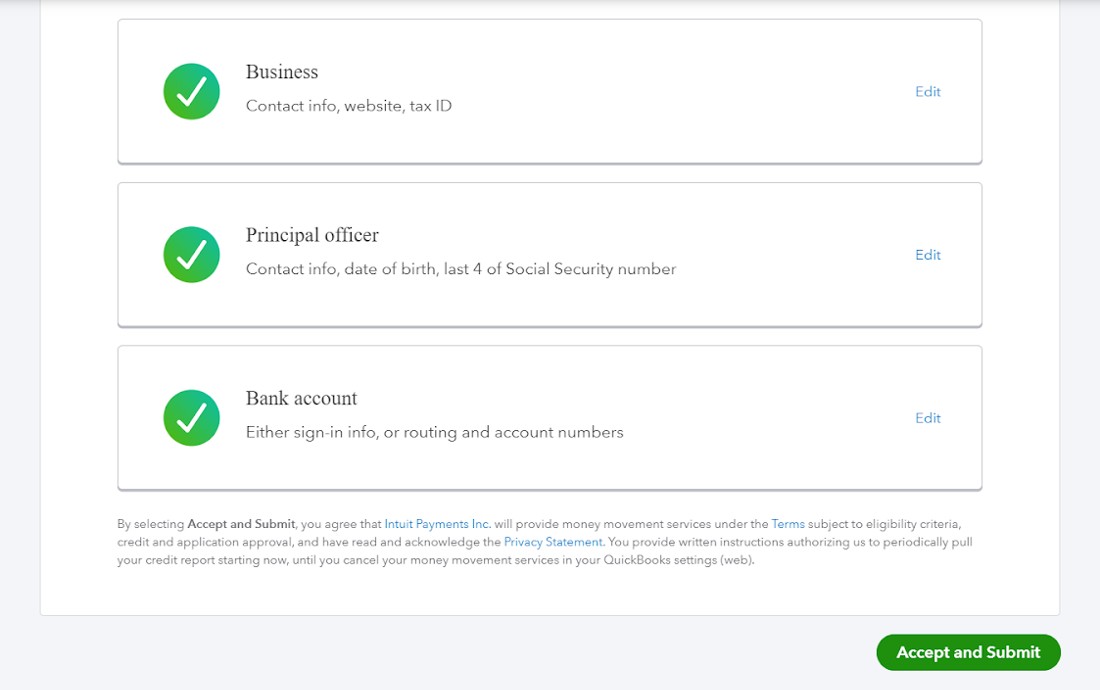

Setup And Pay Owner S Draw In Quickbooks Online Desktop

How To Pay Employees With Direct Deposit In Quickbooks Desktop Payroll Youtube

How Can I Pay Owner Distributions Electronically

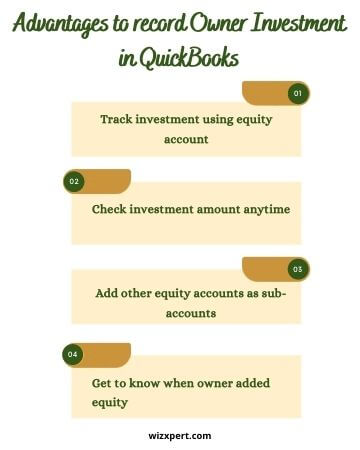

Learn How To Record Owner Investment In Quickbooks Easily

Set Up Quickbooks Online Payroll Youtube

How Can I Pay Owner Distributions Electronically

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

How To Set Up Pay Payroll Tax Payments In Quickbooks

Mastering Quickbooks 2020 Packt

Setup And Pay Owner S Draw In Quickbooks Online Desktop

Owner S Draw Via Direct Deposit Quickbooks Online Tutorial The Home Bookkeeper Youtube